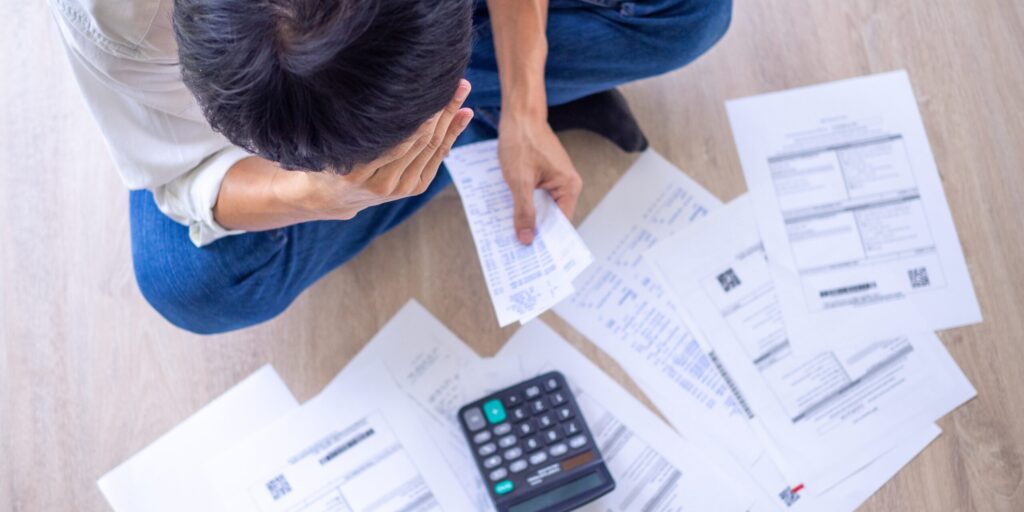

Financial trouble in business often creeps in slowly. It doesn’t start with bankruptcy or a visit from the ATO – it begins with subtle, often overlooked issues that gradually build over time. Recognising these financial distress warning signs early gives you the best chance to turn things around before the situation becomes critical.

For many Australian business owners, especially small-to-medium enterprises, day-to-day operations can make it difficult to see the big picture. But there are patterns that consistently emerge when a business starts to slide toward financial instability.

If you’re noticing any of the following signs, it may be time to take a closer look at your financial health – and speak to an expert before things escalate.

1. Cash Flow Issues Are Clear Financial Distress Warning Signs

One of the most common financial distress warning signs is a consistently tight cash flow. While occasional cash shortages are part of running a business, ongoing problems with meeting day-to-day expenses is a clear red flag.

If you’re delaying payments, dipping into personal funds, or relying on short-term fixes like credit cards or overdrafts, you’re not addressing the underlying issue. Cash flow pressure might be caused by slow-paying customers, high overheads, poor forecasting, or declining sales – but whatever the source, ignoring it can quickly push your business toward insolvency.

Healthy businesses can pay their bills on time. If you’re juggling payments to stay afloat, it’s time to reassess.

2. Missed ATO Obligations Signal Financial Distress Warning Signs

Another serious financial distress warning sign is falling behind on your obligations to the Australian Taxation Office. Missed Business Activity Statements (BAS), late PAYG payments, or unpaid superannuation can trigger penalties, interest charges, and enforcement action.

The ATO takes non-compliance seriously and has been increasing its recovery efforts across Australia. Businesses that ignore tax debt may be subject to garnishee notices, audits, or even Director Penalty Notices (DPNs) – making company directors personally liable.

If you’re avoiding correspondence from the ATO or unsure how much you owe, it’s essential to get advice now. The earlier you engage, the more options you’ll have to manage the situation.

3. Unmanaged Debt Growth Is a Financial Distress Warning Sign

Some debt is normal – and even healthy – for growing businesses. But when debt is being used to cover operating expenses rather than invest in long-term growth, it’s a clear indicator of financial strain.

Using credit to pay wages, suppliers, or rent isn’t sustainable. It creates a debt cycle where interest payments increase and repayments become harder to meet. Refinancing to pay off existing loans may delay the problem, but it rarely solves it.

Uncontrolled or growing debt without a repayment strategy is one of the most dangerous financial distress warning signs. Left unchecked, it leads to insolvency or forced restructuring.

4. Changing Supplier Terms Point to Financial Distress Warning Signs

When suppliers start demanding upfront payment or reducing credit terms, it’s often a sign they’re concerned about your ability to pay. This can be triggered by repeated late payments, ignored invoices, or broken agreements.

The consequences go beyond reputation. Losing access to trade credit puts even more pressure on cash flow and may limit your ability to deliver products or services. In worst cases, a supplier may cease working with your business altogether.

These changes often follow a pattern of behaviour the business owner may not even notice – but they reflect how your business is perceived by others in your network. If supplier relationships are becoming strained, consider it one of the clearest financial distress warning signs to act on.

5. Stress and Avoidance Are Personal Financial Distress Warning Signs

Not all financial distress warning signs are visible in the books. Often, the earliest indicators show up in your own behaviour – stress, sleepless nights, or dread when checking your bank account.

Business owners under pressure often avoid opening letters, delay checking emails, or put off difficult conversations. This avoidance makes problems worse over time, reducing your window of opportunity to fix the situation.

If you’ve started to feel overwhelmed, anxious, or isolated in your business, don’t ignore that instinct. Seeking professional guidance is a strength, not a failure. Acting early gives you the chance to regain control and clarity – often with far more options than if you wait.

What Happens If You Ignore the Financial Distress Warning Signs?

Ignoring these financial distress warning signs can lead to serious consequences. The longer issues go unaddressed, the fewer tools and solutions are available. You may lose the ability to negotiate with creditors, face legal action, or be forced into liquidation.

What many business owners don’t realise is that support is available – and in most cases, earlier intervention leads to better outcomes. From debt negotiation and business restructuring to cash flow recovery plans and ATO liaison, expert guidance can put your business back on a stable footing.

Speak to Wisdom Before It’s Too Late

At Wisdom Business Consultants, we specialise in helping Australian business owners identify and address financial distress warning signs before they become critical. We don’t just look at the numbers – we look at the full picture, including your operational pressures, creditor concerns, and long-term goals.

If you’re concerned your business is struggling, don’t wait until it’s too late. Let’s work together to find a solution, protect your assets, and help your business regain stability and strength.

Ready to talk? Contact Wisdom Business Consultants today and take the first step toward financial clarity. The sooner you act, the more options you’ll have.